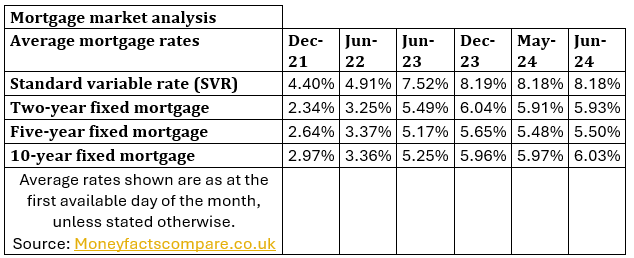

Interest rates for borrowers have been volatile over the past six months, despite no change to the Bank of England base rate according to a new analysis by independent monitor Moneyfactscompare.

Since the start of December 2023, the average two-year fixed rate has fallen from 6.04% to 5.93% and the average five-year fixed rate has fallen from 5.65% to 5.50%.

These average rates have, however, risen from 5.91% and 5.48% respectively since last month.

On a 10-year fixed rate mortgage, the average rate has risen from 5.96% to 6.03% since December 2023. The rate has risen from 5.97% since the start of May 2024.

And the average standard variable rate (SVR) stands at 8.18%, down from 8.19% in December 2023. The rate has not changed month-on-month.

Moneyfactscompare finance expert Rachel Springall says: “Homeowners unsure on whether to lock into a new fixed rate mortgage may still find it more affordable than falling onto a Standard Variable Rate which stands above 8%.

“This rate has almost doubled since the Bank of England started increasing base rate back in December 2021. A typical mortgage being charged the current average SVR of 8.18% would be paying £287 more per month, compared to a typical two-year fixed rate (5.93%).

“Due to volatile swap rates, lenders have been increasing fixed mortgage rates, but are also withdrawing some deals priced below 5%. As a result, the average two-year fixed rate is nearing where it stood six months ago, undoing the positive rate cut momentum seen during the first quarter of 2024.

“The average five-year fixed rate has remained above 5% since June 2023, dipping above and below 6% over the past six months. At present, it’s cheaper to lock into a five-year fixed mortgage than a two-year deal, based on average rates, which has been the case since October 2022. First-time buyers who are struggling to get their foot onto the property ladder and don’t have the ‘Bank of Mum and Dad’ to lean on may feel getting a mortgage is too far out of reach right now.

“Regardless, the uncertainty surrounding interest rates should make it vital for borrowers to seek advice from an independent financial adviser to review all the options available to them.”

.jpg)

Join the conversation

Be the first to comment (please use the comment box below)

Please login to comment