UK house prices increased by 0.3% month on month in July, after taking account of seasonal effects.

This resulted in a slight pickup in the annual rate of house price growth from 1.5% in June, to 2.1% in July - the fastest pace since December 2022. However, prices are still around 2.8% below the all-time highs recorded in the summer of 2022.

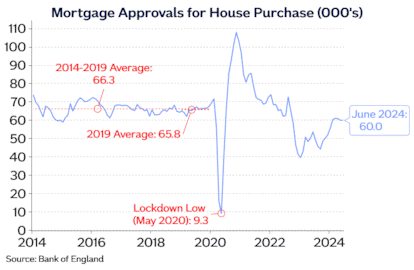

Commenting on the figures, Robert Gardner - Nationwide's chief economist - says: “Housing market activity has been holding relatively steady in recent months with the number of mortgages approved for house purchase at around 60,000 per month. While this is still circa 10% below the level prevailing before the pandemic struck, it is still a respectable pace given the higher interest rate environment.

“For example, for borrowers with a 25% deposit, the rate on a five-year fixed rate deal has been around 4.6% in recent months, more than double the 1.9% average recorded in 2019. As a result, affordability is still stretched for many prospective buyers. Indeed, for an average earner buying a typical first-time buyer property, the monthly mortgage payment is equivalent to around 37% of take-home pay, well above the 28% prevailing pre-Covid and the long-run average of circa 30%.

“Investors expect Bank Rate to be lowered modestly in the years ahead, which, if correct, will help to bring down borrowing costs. However, the impact is likely to be fairly modest as the swap rates which underpin fixed-rate mortgage pricing already embody expectations that interest rates will decline in the years ahead.

“As a result, affordability is likely to improve only gradually through a combination of wage growth outpacing house price growth (which is expected to remain fairly flat), with some support from modestly lower borrowing costs.”

Join the conversation

Be the first to comment (please use the comment box below)

Please login to comment