Extra help for first-time home buyers is on the way as Lloyds Banking Group increases the amount prospective homeowners can borrow,...

Archive

02 September 2024

From: Breaking News

New data from Santander shows that parents wanting children to attend one of the top 500 state primary schools outside of...

29 August 2024

From: Breaking News

Mojo Mortgages’ data has revealed that extending a mortgage from 25 to 35 years can cost the average first-time buyer an...

27 August 2024

From: Breaking News

A new study by David Wilson Homes reveals over half of Britons are unfamiliar with the stamp duty fee – and...

21 August 2024

From: Breaking News

Mortgage and protection brokerage Access Financial Services has reported what it calls “exceptional growth” with turnover up 46% between April 2023...

12 August 2024

From: Breaking News

Home buyers, movers, and existing owners making energy-saving improvements to their properties can now get up to £2,000 cashback from a...

07 August 2024

From: Breaking News

NatWest has announced it will introduce new Airbnb-friendly mortgage terms that embrace home sharing via short lets. And now Airbnb wants...

22 July 2024

From: Breaking News

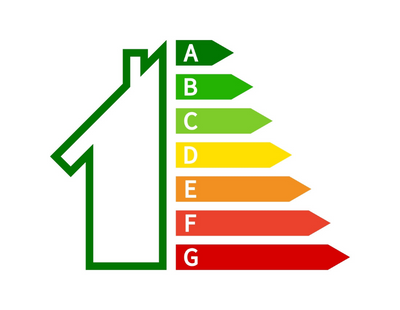

UK lender Standard Life Home Finance has announced a new EPC scheme to encourage consumers to make their homes more sustainable. Upon...

17 July 2024

From: Breaking News

New research from the Intermediary Mortgage Landers Association suggests that the cumulative shortfall in first-time buyer numbers since the financial crisis...

01 July 2024

From: Breaking News

Buckinghamshire Building Society has launched a new non-standard credit buy to let mortgage, following what it calls “significant broker demand.” The BTL...

17 June 2024

From: Breaking News

Official Bank of England figures shows that net mortgage approvals for house purchases totalled 61,100 in April, little changed from 61,300...

05 June 2024

From: Breaking News

LiveMore, the mortgage lender for people aged 50 to 90 plus, has launched a new up to 100% standalone debt consolidation...

22 May 2024

From: Breaking News

Savills has today upgraded its five-year UK mainstream house price forecast to reflect the stronger than expected start to the year...

07 May 2024

From: Breaking News

The proportion of buy to let properties purchased in Southern England fell to a record low last year, continuing a trend...

01 May 2024

From: Breaking News

There’s been a huge rise in the number of buy to let property repossessions in the first quarter of 2024 compared...

08 April 2024

From: Breaking News

Recent economic data was reassuringly predictable. We learned that core inflation fell by fractionally more than expected while services inflation proved slightly...

04 April 2024

From: Breaking News

Yorkshire Building Society new fee-free offer will enable first-time buyers across England, Scotland or Wales with a £5,000 deposit to purchase...

02 April 2024

From: Breaking News

The beleaguered construction sector - a good early indicator of later sales activity - has seen a welcome boost in some...

27 March 2024

From: Breaking News

UK Finance says there were 93,680 homeowner mortgages in arrears of 2.5 per cent or more of the outstanding balance in...

12 February 2024

From: Breaking News

The number of mortgages offered to home buyers went up from 49,300 in November to 50,500 in December, against the normal...

05 February 2024

From: Breaking News

Leading agency Knight Frank says demand for new homes is generally robust, dependent upon the location and pricing. It says its regional...

24 January 2024

From: Breaking News

A new survey - going against the trend of other housing market studies - suggests that house prices could rise six...

13 December 2023

From: Breaking News

The Nationwide wants greater government support for first-time buyers as rising costs delay owning a home. As one of the UK’s biggest...

29 November 2023

From: Breaking News

The buy-to-let sector has seen fixed rates fall and product choice grow month-on-month, according to the latest analysis by Moneyfactscompare. Overall buy-to-let...

16 October 2023

From: Breaking News

The number of three-year fixed mortgage products available from lenders has been rising over the last few months as borrowers coming...

02 October 2023

From: Breaking News

Half a million mortgage-holders are facing an imminent financial shock as their fixed deals end in the run-up to Christmas or...

25 September 2023

From: Breaking News

A study of 7,000 people by a specialist predicts the UK specialist residential mortgage market will treble to £16 billion by...

04 September 2023

From: Breaking News

The Co-operative Bank has bagged the entire Sainsbury’s Bank mortgage portfolio of some 3,500 customers with balances of £479m. Sainsbury’s customers are...

14 August 2023

From: Breaking News

Proptech company OneDome’s mortgage advisory firm CMME is launching a new scheme exclusively designed for self-employed mortgage advisers. The brand wants to...

08 August 2023

From: Breaking News

The latest house price index - this one from the Halifax - has triggered a huge wave of concern about the...

11 July 2023

From: Breaking News

LendInvest has announced a £500m investment to contribute towards the cost of new Buy To Let and Residential Mortgage products. This new...

11 July 2023

From: Breaking News

.png)

Mortgage approvals rose by just over three per cent from 49,000 in April to 50,500 in May according to new Bank...

04 July 2023

From: Breaking News

The Bank of England’s monetary policy committee does not meet until June 22 but that doesn’t mean there’s any let up...

13 June 2023

From: Breaking News

Accord is once again cuts rates across its residential mortgage range by between 0.15% and 0.25%, at a time when market...

25 April 2023

From: Breaking News

Accord Mortgages is making further changes to its buy-to-let and residential rates. For the second time in as many weeks, buy to...

04 April 2023

From: Breaking News

Newcastle Building Society has reported record lendings for 2022 of £586 million. Significant support was provided to Members, clients, and colleagues during...

07 March 2023

From: Breaking News

Advisers looking to place business with Leek Building Society via Legal & General Mortgage Club will now benefit from access to...

07 February 2023

From: Breaking News

Accord Mortgages has made changes to its buy-to-let range to offer lower rates to brokers and their clients. The intermediary-only lender is...

31 January 2023

From: Breaking News

National brokerage Just Mortgages has kicked off the new year with the appointment of five new regional directors to support its...

24 January 2023

From: Breaking News

Staying close to a mortgage broker will be an important part of timing a house purchase correctly in 2023. Mortgage rates will...

24 January 2023

From: Breaking News

Benham and Reeves claim that London’s most up and coming neighbourhoods have seen price increases up to 64.5%. House price increases of up...

10 January 2023

From: Breaking News

Estate agent comparison site, GetAgent.co.uk, has revealed which postcodes estate agents with the highest turnovers reside. Registered property transactions over 3 months, the...

03 November 2022

From: Breaking News

With Halloween around the corner, new research by GetAgent.co.uk looks into the value of Halloween-related road names. An in-depth analysis of sold price data...

27 October 2022

From: Breaking News

The FinTech mortgage lender using AI to simplify the mortgage journey for homebuyers and re-mortgagers, MPowered Mortgages, has recently expanded its...

13 October 2022

From: Breaking News

The latest research by Alliance Fund shows that the government’s decision to cut stamp duty could boost new housing delivery by 16%. The changes...

03 October 2022

From: Breaking News

As a result of the current high rates of upward house price growth, research by property purchasing specialist, HBB Solutions, has...

30 September 2022

From: Breaking News

The government announced the SDLT will only be payable on property purchases over £250,000. First-time buyers will only pay the tax...

27 September 2022

From: Breaking News

The latest research from property purchasing specialist, HBB Solutions, revealed that some areas in England have seen up to £183,266 wiped off the...

22 September 2022

From: Breaking News

Identity checks remain a crucial part of the home moving process, yet new research shows that regulated firms using manual methods...

15 September 2022

From: Breaking News

A study done by RIFT Tax Refunds has disclosed just how much the average person would need to see their pay...

30 August 2022

From: Breaking News

The cost-of-living crisis has caused homeowners and tenants across the globe to seek ways to lower their energy bills. Experts forecast...

16 August 2022

From: Breaking News

New research by mortgage broker, Henry Dannell, reveals that equity release can help homeowners add serious value to their property. By analysing...

12 July 2022

From: Breaking News

In this guest piece, Adrian Plant, director of Shared Ownership at Leaders Romans Group and Calum Toone, mortgage advisor at Mortgage Scout, delve into the...

30 June 2022

From: Breaking News

In the UK, homeownership remains one of the main aspirations for young adults and families who envision climbing the property ladder...

21 June 2022

From: Breaking News

Taking inspiration from the Queen’s Platinum Jubilee celebrations, the property platform, Boomin, has revealed just how much it will take from...

02 June 2022

From: Breaking News

This week’s roundup takes a look at the latest in the mortgage market, from L&G’s latest addition to its lender panel...

26 May 2022

From: Breaking News

Over the weekend, Nat Daniels - CEO of Angels Media, the founder of the Today sites - penned this piece in...

17 May 2022

From: Breaking News

The latest research by the rental platform Ocasa reveals that the cost of rent in the UK is set to drastically increase. The annual...

28 April 2022

From: Breaking News

Stipendum, the platform that aims to simplify life’s complex events, has released a number of top tips to help the nation’s...

19 April 2022

From: Breaking News

After 37 years on air, popular Australian soap opera Neighbours is due to come to an end, but a positive for...

22 March 2022

From: Breaking News

In celebration of St. Patrick’s Day, estate agent Barrows and Forrester discovers which Paddy’s-themed street names, from Guinness to Clover, command...

17 March 2022

From: Breaking News

This week’s mortgage roundup showcases the benevolence of the mortgage sector, with The Cambridge relaunching its products for expats, while Newcastle...

10 March 2022

From: Breaking News

A study by GetAgent.co.uk has shown how the nation’s property sellers could be left with a particularly sweet taste in their...

01 March 2022

From: Breaking News

This week’s mortgage roundup is all about simplifying the homebuying journey, with a new partnership formed to streamline the buying process and...

24 February 2022

From: Breaking News

Property platform Boomin revealed which postcodes in England are the most and least affordable. Postcodes home to a gap of up...

22 February 2022

From: Breaking News

A study by MoveStreets, the property portal designed for the mobile generation, has found that garden offices, garage conversions and kitchen...

22 February 2022

From: Breaking News

Research from the property platform, Boomin, has discovered that living on a Valentine’s related road name could provide a substantial boost...

10 February 2022

From: Breaking News

New research conducted by the property lending experts, Octane Capital, claims that over the last five years the buy-to-let sector has...

03 February 2022

From: Breaking News

The value of the nation’s spare rooms is estimated at around £791.5 billion, and that’s just those of homeowners that admit...

25 January 2022

From: Breaking News

2021 proved to be one of the most hectic years to buy and sell a home. We witnessed prices soaring to...

13 January 2022

From: Breaking News

A study by GetAgent.co.uk has found the cost of buying a property across one of the nation’s festive road names, with a...

23 December 2021

From: Breaking News

First-time buyers (FTBs) that have bought their home in the last 18-month period since March 2020 have experienced an increasingly expensive...

09 December 2021

From: Breaking News

This mortgage roundup highlights the latest updates and features from the UK’s leading lenders, from custom-build mortgage products and holiday let mortgages,...

11 November 2021

From: Breaking News

Bective, the sales, lettings and property management company, recently revealed how superstitions around the number 13 often lead to homebuyers paying less for properties. Traditionally it is considered to...

28 October 2021

From: Breaking News

Perhaps the scariest thing to occur in the property market is the fall of house prices, with the latest property market...

28 October 2021

From: Breaking News

Market estate agency comparison website GetAgent.co.uk recently revealed how the stamp duty holiday has made house prices difficult for the first-time...

24 September 2021

From: Breaking News

Research by GetAgent has revealed how asking prices across many areas of the property market tumbled in the wake of the...

13 August 2021

From: Breaking News

According to new research from the homebuying platform, YesHomebuyers, the majority of UK homeowners spend between £500 to £1,500 a year on...

06 July 2021

From: Breaking News

West One Loans’ buy-to-let (BTL) division has released new products to meet increased demand in the market. The raft of new product...

01 July 2021

From: Breaking News

According to new research from equity adviser Key, the Bank of Gran and Grandad has gifted nearly £1 million a day...

24 June 2021

From: Breaking News

Wealth management and property lending specialist Tier One Capital has secured a £6.5 million revolving credit facility from Shawbrook Bank for...

24 June 2021

From: Breaking News

According to new research from Direct Line Life Insurance, 6.3 million Brits would choose marriage over a mortgage. The research also...

17 June 2021

From: Breaking News

Roma Finance completed a record month in May, reporting a 50% increase in pipeline business on top of the 100% increase...

15 June 2021

From: Breaking News

Despite market delays, over half a million homebuyers in England are set to benefit from the stamp duty holiday to the...

08 June 2021

From: Breaking News

Pure Retirement has announced the launch of its new flexible pricing methodology on the Classic lifetime mortgage product range. The new initiative...

04 June 2021

From: Breaking News

The past year has seen many people experience a change in their financial circumstances. The Covid-19 pandemic resulted in work-life changes...

04 June 2021

From: Breaking News

Following the success of its first Virtual National Training Event in November 2020, The Right Mortgage and Protection Network has announced...

13 April 2021

From: Breaking News

more2life has partnered with robotic process automation specialists Robiquity to speed up its core servicing processes for lenders. The partnership has seen...

30 March 2021

From: Breaking News

Newbury Building Society has introduced a GoGreen Reward incentive to its self-build mortgage to encourage homebuilders to make conscious sustainable choices. The...

23 March 2021

From: Breaking News

Over half a million transactions will save due to the stamp duty holiday extension by the time it ends in September...

18 March 2021

From: Breaking News

Property buyers in certain cities could enjoy a hat-trick of savings via the stamp duty holiday, a reduced mortgage deposit requirement and...

09 March 2021

From: Breaking News

Roma Finance has rebranded across all channels to providing lending less ordinary as standard. As part of its ambitious growth strategy, the...

09 March 2021

From: Breaking News

With tomorrow’s Budget expected to be one of the most significant in recent history, fresh research by MoneySuperMarket reveals 74% of...

02 March 2021

From: Breaking News

Older homeowners gifted an average of £42,500 to younger relatives to help them get on the property ladder in 2020, new...

25 February 2021

From: Breaking News

West One Loans’ buy-to-let (BTL) division has announced major criteria changes which will see maximum borrower exposure limits raised by more...

16 February 2021

From: Breaking News

The majority (83%) of first-time buyers in the UK currently house-hunting have had no financial support from their parents, new research...

02 February 2021

From: Breaking News

The current stamp duty holiday has already saved homebuyers an estimated £817 million, with the potential to reach £1.5 billion before...

02 February 2021

From: Breaking News

West One Loans’ buy-to-let division has announced new product launches and lower prices to broaden its product range. The new range will...

19 January 2021

From: Breaking News

Almost half (49%) of consumers who purchased a mortgage recently said they felt more secure dealing with a lender directly, research...